Are you aware of the importance of maintaining a good credit score? Your credit score plays a significant role in determining your financial health and can impact your ability to secure loans, credit cards, and even apartments. In this article, we will delve into the world of credit scores, credit reports, and credit checks, and explore how TransUnion can help you navigate this complex landscape.

What is a Credit Score?

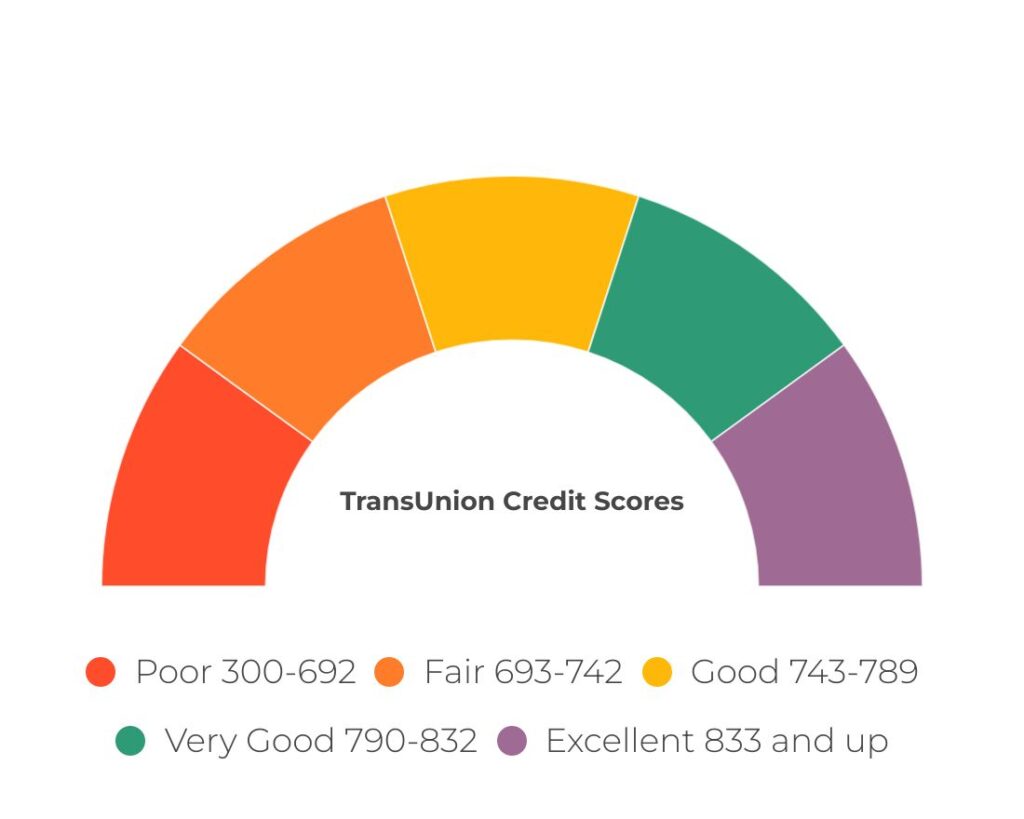

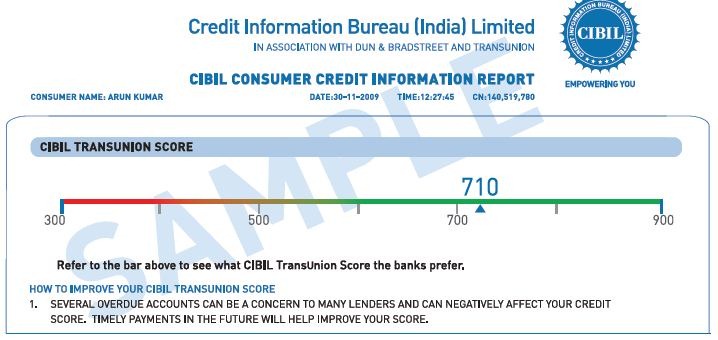

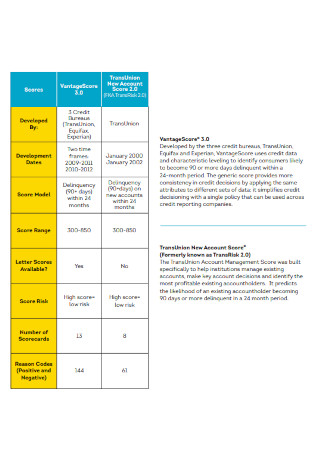

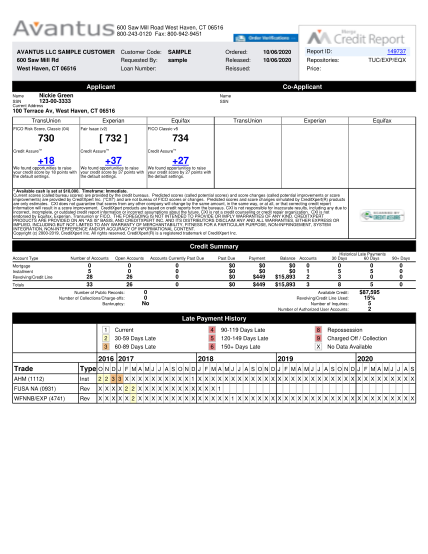

A credit score is a three-digit number that represents your creditworthiness, ranging from 300 to 850. It is calculated based on your credit history, payment history, credit utilization, and other factors. A good credit score can help you qualify for better loan rates, lower interest rates, and more favorable credit terms. On the other hand, a poor credit score can limit your access to credit and increase the cost of borrowing.

What is a Credit Report?

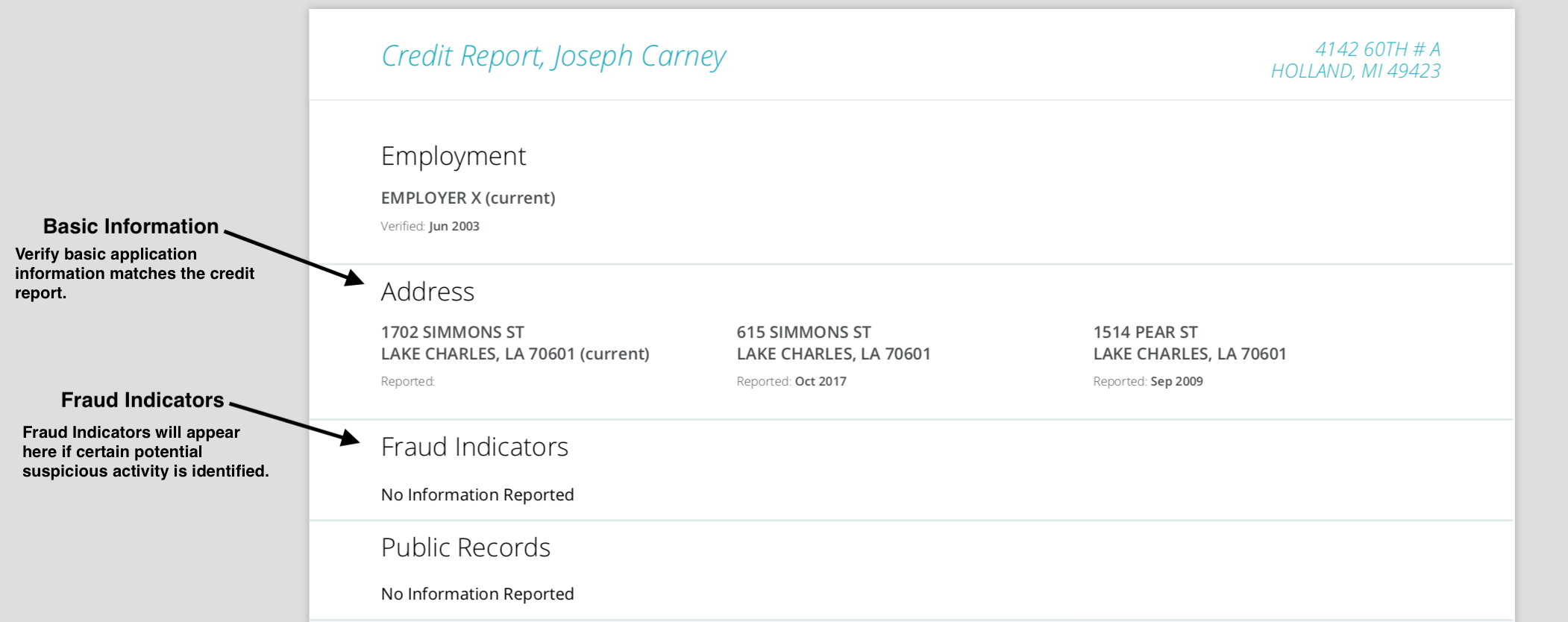

A credit report is a detailed document that outlines your credit history, including your payment history, credit accounts, and public records. It is used by lenders to evaluate your creditworthiness and determine the risk of lending to you. Your credit report is maintained by credit reporting agencies, such as TransUnion, and is updated regularly.

What is a Credit Check?

A credit check is a process where a lender or creditor reviews your credit report to assess your creditworthiness. This can happen when you apply for a loan, credit card, or other forms of credit. A credit check can result in a hard inquiry, which can temporarily lower your credit score.

How Does TransUnion Help?

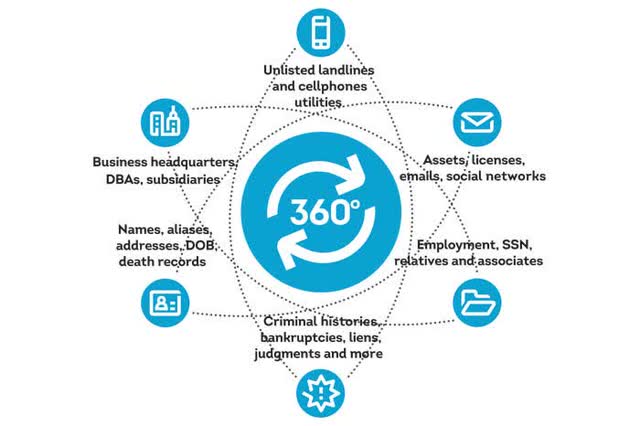

TransUnion is one of the three major credit reporting agencies in the United States, along with Equifax and Experian. TransUnion provides a range of services to help you manage your credit, including:

Credit Monitoring: TransUnion offers credit monitoring services that alert you to changes in your credit report, helping you stay on top of your credit health.

Credit Reports: You can request a free credit report from TransUnion once a year, which can help you identify errors or inaccuracies in your report.

Credit Scores: TransUnion provides access to your credit score, giving you a clear picture of your creditworthiness.

Identity Theft Protection: TransUnion offers identity theft protection services that help safeguard your personal and financial information.

Tips for Maintaining a Good Credit Score

To maintain a good credit score, follow these tips:

Make On-Time Payments: Pay your bills on time, every time, to demonstrate responsible credit behavior.

Keep Credit Utilization Low: Keep your credit utilization ratio below 30% to avoid negatively impacting your credit score.

Monitor Your Credit Report: Regularly review your credit report to ensure accuracy and detect potential errors.

Avoid New Credit Inquiries: Limit new credit applications to avoid multiple hard inquiries, which can lower your credit score.

In conclusion, understanding your credit score, credit report, and credit check is crucial for maintaining good financial health. TransUnion provides valuable tools and services to help you navigate the complex world of credit. By following the tips outlined above and leveraging TransUnion's resources, you can take control of your credit and unlock better financial opportunities.

Check your credit score and report today and start building a stronger financial future.